The Short Answer: Yes, But With Limits The IRS does have the power to levy retirement accounts for unpaid taxes. However, not all retirement income is treated equally…

The Short Answer: Yes, But With Limits The IRS does have the power to levy retirement accounts for unpaid taxes. However, not all retirement income is treated equally…

Penalty Abatement FAQs Can the IRS remove penalties on my tax debt? Yes. The IRS offers several paths to penalty relief, including First-Time Penalty Abatement (FTA), Reasonable Cause,..

If you have been hit with IRS penalties, you may be wondering how long it will take for the IRS to review a request for relief. The penalty..

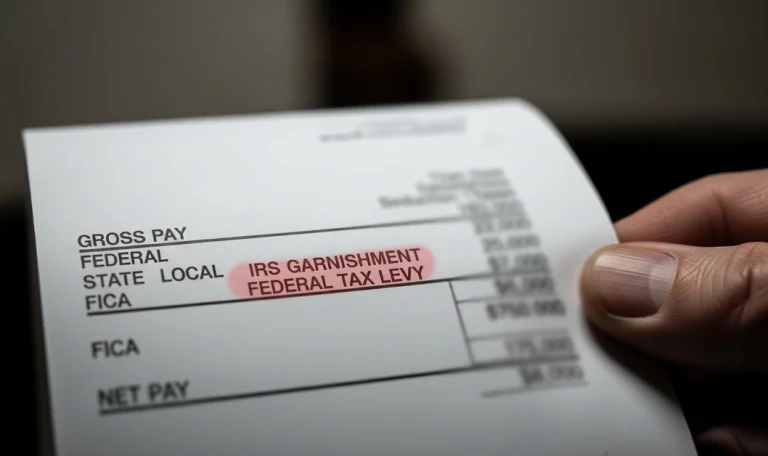

The Short Answer: Yes The IRS has the legal authority to garnish wages if you owe back taxes. This is called a wage levy, and it allows the..

Few IRS actions create more panic than a bank levy. One day your account looks normal, the next it’s frozen. The IRS can direct your bank to hold..

IRS Seizure Authority Explained When taxpayers fall behind on their federal tax obligations, the IRS has powerful tools to collect. One of the most serious is the ability..

The Short Answer: Yes, But It’s Rare The IRS does have the authority to seize property — including homes and vehicles — when back taxes go unpaid. However,..

The Short Answer: Yes, With Limits The IRS can levy Social Security benefits if you owe back taxes. However, the garnishment is capped at 15% of your monthly..

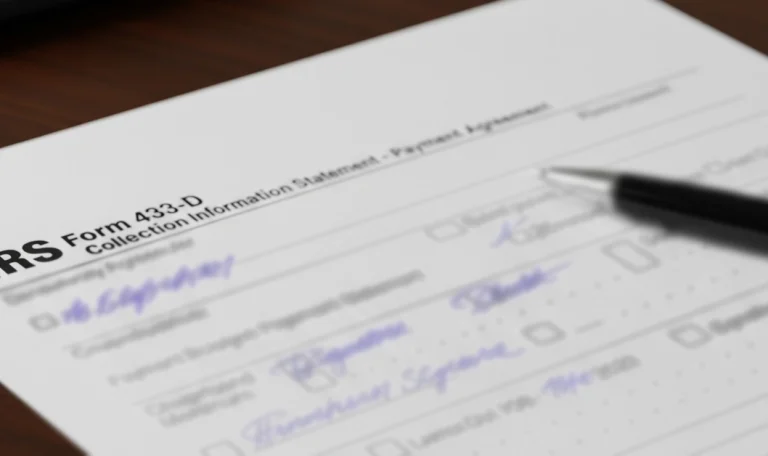

IRS Form 433-D is a short form used to finalize a Direct Debit Installment Agreement (DDIA) with the IRS. It authorizes the IRS to automatically withdraw monthly payments..

An IRS payment plan, also called an installment agreement, can make tax debt manageable. But what if you miss payments or fall out of compliance? Defaulting on a..